Piercing Line Candlestick Pattern Strategy

The Piercing Line is one of the technical analysis’s most popular candlestick patterns. It is a bullish reversal pattern that forms when the opening price is lower than the close of the previous candlestick, but the close of the current candlestick is higher than its opening.

If you’re looking for an effective trading strategy, look no further than the piercing line. This strategy is simple to understand and easy to execute, making it a popular choice among traders.

This guide will teach you everything you need to know about the piercing line strategy, including how to identify and trade with this pattern. We’ll also provide some tips for improving your results. So whether you’re a beginner or an experienced trader, the piercing line can help you succeed in the markets.

What is a Piercing Line?

The piercing line candlestick pattern is an indication of a bullish reversal that develops near the end of a downtrend. As bulls enter the market and drive prices higher, it frequently results in a trend reversal.

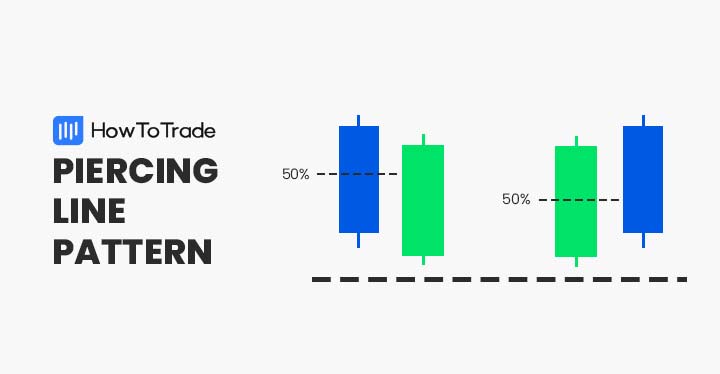

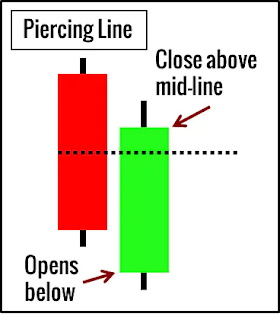

This candlestick pattern is created when buyers drive prices higher to close above 50% of the first candle’s body. The first candle is typically black, and the second candle is white.

The appearance of this pattern is a red flag for sellers since an upward reversal is possible. This pattern indicates that bulls are beginning to enter the market and that prices are likely to move higher. As such, traders should be on alert for potential buying opportunities.

How do you Trade a Piercing Line?

The piercing line candlestick pattern indicates a trend change. However, depending solely on the piercing line pattern to provide a purchase signal may be insufficient. The pattern must be seen in conjunction with other indicators that indicate a buy signal. To make a piercing line pattern, the second candle must cover only half of the first candle.

It is not necessary to cover the entire red candle. It signifies that the bulls could not entirely reverse their losses from the previous day. When additional technical indicators, such as RSI, Stochastic, or MACD, indicate a positive divergence while creating a piercing line pattern, the upward trend is more likely to continue.

Another straightforward but critical factor to examine is the trade volume. If the volume on the second day is higher than usual, it is a stronger indicator that the downward trend is likely to end.

Piercing Pattern Success Rate

Out of all the patterns that technical analysis uses to try and understand markets, the Piercing pattern is one of the more successful.

On average, it confirms 72.9% of the time across the 4120 markets studied. This pattern is generally confirmed within 2.3 candles or invalidated within 4.3.

This pattern is valid since it assists traders in gaining a better understanding of whether the momentum of the market is bullish or bearish. If the market rallies after breaking through a previous low, this indicates that bullish momentum is likely present in the market.

If, on the other hand, prices drop after breaking past a previous high, this indicates that the market is likely to be moving in a bearish direction.

The piercing pattern is a useful tool for traders who are attempting to make sense of the movements in the market, despite the fact that no pattern is flawless.

Formation of a Piercing Pattern

The piercing line candlestick pattern develops over two days, with the first stick dominated by sellers and the second by purchasers. It denotes a trend reversal and hints at a short-term upward advance.

A downward price trend typically precedes the piercing line candle pattern. It indicates that the supply of shares to be sold has reached its maximum, and purchasers have gradually begun to dominate the market, driving up the price of the shares.

Two consecutive candles make the piercing line candlestick pattern. With an average or wider trading range, the first candle opens near the high and ends near the low. The first candle is red because it represents a downward progression. A green candle follows the red candle; however, some fine signs must be considered.

A piercing candlestick pattern forms when the market is already in a downward trend, the opening price is high, and the selling activity is ongoing. The closing price reaches the bottom at the end of the trading session, forming a bearish candle. This bearish candlestick is typically a Marubozu candlestick with no upper or lower shadows.

The next bearish candlestick’s beginning point is lower than the preceding bearish candlestick’s closing point. The bulls boost their demand, and the price begins to rise. After the day, the bulls prevailed, and the closing price was higher than the center of the previous bearish candlestick.

This pattern indicates a potential reversal in the downward trend, as the bulls can take control and push prices up. Traders may watch for opportunities to enter long positions when this pattern forms.

Comments

Post a Comment