The Best Scalping Indicator in 2023

Discover the top-rated best scalping indicator that can supercharge your trading strategy. Uncover insights, expert advice, and FAQs about scalping in this comprehensive guide.

Introduction

In the fast-paced world of trading, finding the right tools and strategies can make all the difference. Scalping, a popular trading technique, relies heavily on having the best scalping indicator at your disposal. In this article, we’ll explore the intricacies of scalping, unveil the most effective scalping indicators, and provide you with valuable insights to help you succeed in the world of trading.

What is Scalping?

Scalping is a trading strategy where traders make rapid, short-term trades to profit from small price movements. To be successful, scalpers need a reliable scalping indicator to identify entry and exit points swiftly.

The Crucial Role of the Best Scalping Indicator

Having the best scalping indicator is paramount in scalping. It serves as your eyes in the market, helping you spot the perfect moments to enter and exit trades. Let’s delve into the essential aspects of choosing the right scalping indicator.

Identifying the Ideal Indicator

Choosing the right scalping indicator involves considering various factors. It should provide real-time data, be easy to interpret, and offer customization options. Some of the best scalping indicators include Moving Averages, Relative Strength Index (RSI), and the Stochastic Oscillator.

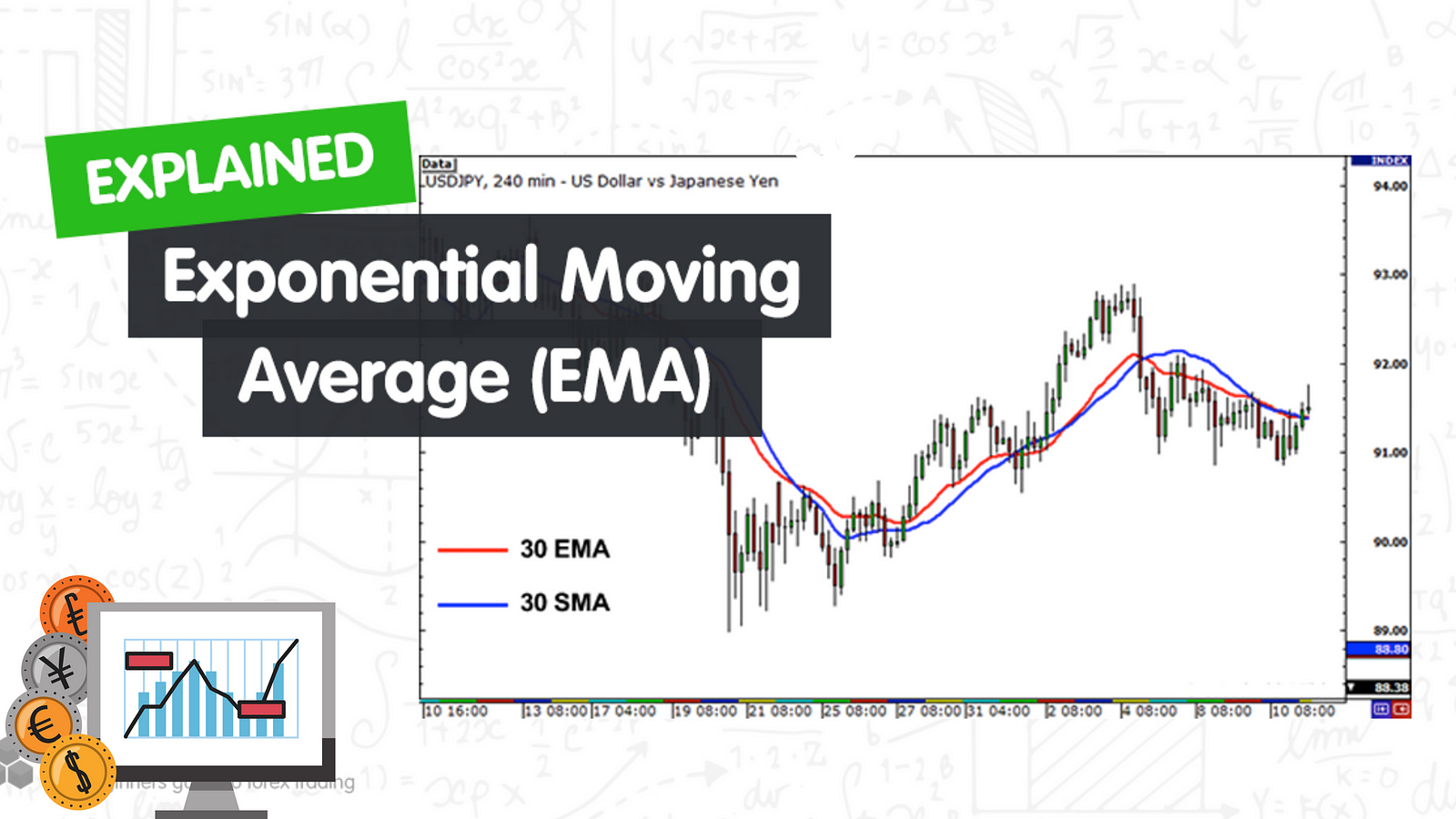

Utilizing Moving Averages

Moving Averages are a versatile tool for scalpers. They help identify trends and determine the right entry and exit points. A simple moving average (SMA) and an exponential moving average (EMA) are popular choices for scalpers.

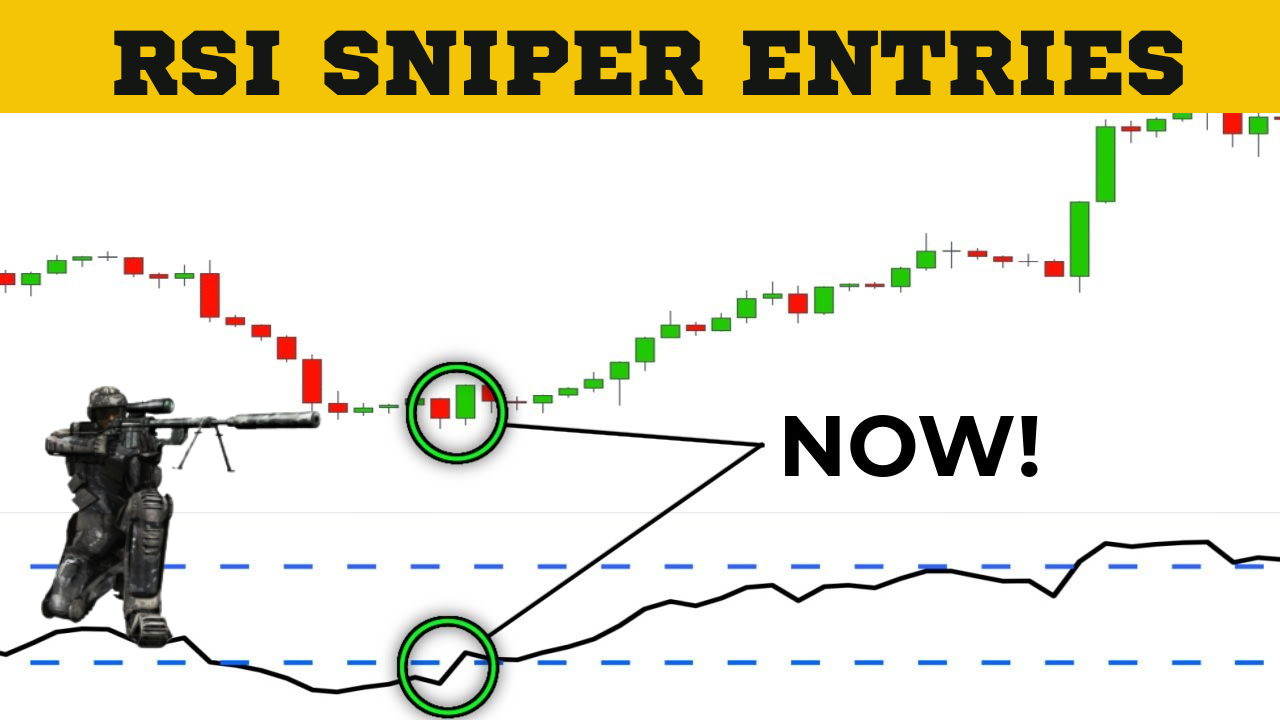

Unveiling RSI as a Game-Changer

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It helps traders identify overbought and oversold conditions, making it a valuable scalping tool.

Leveraging the Stochastic Oscillator

The Stochastic Oscillator is another powerful indicator for scalping. It indicates overbought and oversold conditions, making it useful for pinpointing potential reversals.

FAQs

What is the ideal time frame for scalping?

The ideal time frame for scalping is typically the 1-minute or 5-minute charts. These shorter time frames allow scalpers to capture rapid price movements.

How do I manage risk in scalping?

Risk management is crucial in scalping. Set stop-loss and take-profit orders to protect your capital. Never risk more than a small percentage of your trading account on a single trade.

Can I use scalping indicators for other trading strategies?

Yes, scalping indicators can be useful for other trading strategies, but they are most effective in scalping due to their focus on short-term price movements.

Is scalping suitable for beginners?

Scalping is a high-risk, high-reward strategy that may not be suitable for beginners. It requires quick decision-making and a deep understanding of market dynamics.

How do I choose the best scalping indicator for my trading style?

Choosing the best scalping indicator depends on your trading style and preferences. Experiment with different indicators and select the one that aligns with your strategy.

Are scalping indicators foolproof?

No, scalping indicators are not foolproof. They are tools that assist in decision-making, but success in scalping also depends on your skills, experience, and market conditions.

Conclusion

In the world of trading, the right tools can be the key to success. When it comes to scalping, having the best scalping indicator is non-negotiable. By understanding the indicators at your disposal and learning to interpret them effectively, you can unlock the profit potential of scalping. Remember, trading is inherently risky, and it’s essential to practice prudent risk management.

Comments

Post a Comment