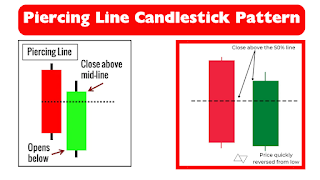

How To Use Piercing Line Candlestick Pattern | Piercing Line Candlestick Pattern Strategy

The Piercing Line candlestick pattern is a two-day pattern that signals a potential bullish reversal in a downtrend. The pattern consists of a long bearish candlestick followed by a bullish candlestick that opens below the previous day's close but closes above the mid-point of the prior candlestick's body. The close should also cover at least half of the upward length of the previous day's red candlestick body.

Here are the steps to trade the Piercing Line pattern:

- Identify the pattern: The pattern emerges during a clear downtrend. The first candle is a bearish one, and the second is bullish, opening lower than the previous day's close but closing more than halfway into the body of the previous day's candle.

- Confirm the pattern: Confirm the pattern by looking for other technical indicators such as volume, moving averages, and trend lines.

- Enter the trade: Enter the trade when the second candlestick closes above the mid-point of the first candlestick's body.

- Place a stop-loss: Place a stop-loss order below the low of the first candlestick.

- Take profit: Take profit when the price reaches a predetermined level or when the trend starts to reverse

Comments

Post a Comment