rsi and bollinger bands strategy

The Bollinger Bands and Relative Strength Index (RSI) are two popular technical indicators that traders often combine to verify signals and make smarter decisions

The Bollinger Bands are a tool that uses standard deviation ranges from a center line calculated using a simple moving average to create a flexible and adaptable tool

The RSI, on the other hand, is a momentum oscillator that measures the speed and change of price movements

To use the RSI with Bollinger Bands, traders should first look for situations where the RSI line breaches the upper or lower Bollinger Bands. When the RSI exceeds the upper band, it signals a potential overbought condition, indicating that a price correction or reversal may be imminent. Conversely, when the RSI drops below the lower band, it suggests an oversold condition, pointing to a potential price increase

Here are some tips for incorporating RSI with Bollinger Bands into your trading strategy

- Use the RSI with Bollinger Bands indicator and other technical analysis tools to confirm potential trade signals.

- Set appropriate stop-loss and take-profit levels to manage risk and protect your trading capital.

- Test the indicator on historical data before incorporating it into your trading strategy.

What are the best settings for Bollinger Bands and RSI indicators?

The best settings for Bollinger Bands and RSI indicators may vary depending on the trader's preferences and the asset being traded. However,

here are some recommended settings

Bollinger Bands:

- The best setting for Bollinger Bands is 10, 2, or 2 on an OHLC daily chart, which yields a 55% win rate.

- John Bollinger recommends using settings of 9–12 based on a 2-standard deviation.

- A common starting point for a 1-minute chart is a 20-period SMA and 0.5 or 0.75 standard deviations.

- A common starting point for a 15-minute chart is a 20-period SMA and 2.5

RSI:

- The RSI is a momentum oscillator that measures the speed and change of price movements.

- To use the RSI with Bollinger Bands, traders should first look for situations where the RSI line breaches the upper or lower Bollinger Bands.

- When the RSI exceeds the upper band, it signals a potential overbought condition, indicating that a price correction or reversal may be imminent. Conversely, when the RSI drops below the lower band, it suggests an oversold condition, pointing to a potential price increase.

How to backtest Bollinger Bands and RSI strategies?

To backtest Bollinger Bands and RSI strategies, traders can follow these steps:

- Define the strategy: Define the rules of the strategy, including entry and exit signals, stop-loss and take-profit levels, and any other relevant parameters.

- Gather historical data: Collect historical price data for the asset being traded, including open, high, low, and close prices.

- Apply the strategy to the historical data: Apply the strategy to the historical data to determine how it would have performed in the past. This can be done manually or using backtesting software.

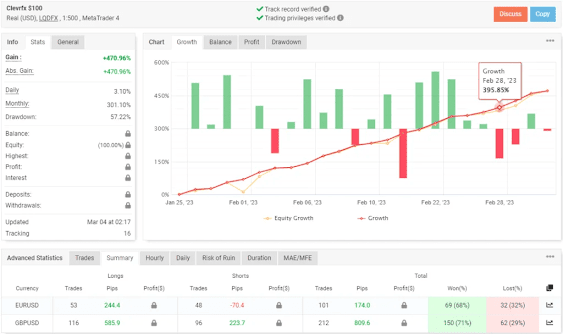

- Analyse the results: Analyse the results of the backtest to determine the strategy's win rate, average profit and loss, and other relevant metrics.

- Optimise the strategy: Use the results of the backtest to optimise the strategy by adjusting the parameters to improve its performance.

- Test the strategy on new data: Test the optimised strategy on new data to ensure its effectiveness before using it in live trading.

.gif)

Comments

Post a Comment